While most DeFi platforms are designed for retail crypto users, Coreum is taking decentralized finance to the next level by bridging institutions with compliant DeFi ecosystems.

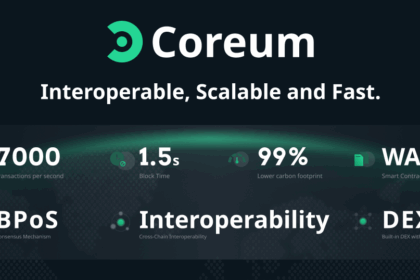

With the CORE Token as its fuel, coreum.com is building the first blockchain framework that empowers banks, asset managers, and enterprises to offer on-chain financial services without compromising on speed, security, or regulatory requirements.

What Is Institutional DeFi?

Institutional DeFi blends decentralized financial infrastructure with:

- ✅ Regulatory compliance

- ✅ Risk management tools

- ✅ Institutional-grade liquidity access

- ✅ Real-world asset integration

It enables regulated entities to benefit from DeFi’s efficiency without the legal risks or technical barriers of traditional crypto platforms.

Coreum’s Institutional DeFi Features

✅ Smart Contract Automation

- Power automated lending, staking, derivatives, and settlement

- Build custom financial products on-chain

✅ Compliance Modules

- Integrate KYC/AML and jurisdictional restrictions directly into tokenized products

- Allow institutions to meet legal requirements

✅ Tokenized Real-World Assets

- Enable on-chain trading of regulated securities like:

- Bonds

- Real estate

- Commodities

- ETFs

✅ High-Performance Execution

- Handle institutional trading volumes with:

- ⚡ Sub-second finality

- 💸 Ultra-low fees

- 🌐 Cross-chain liquidity access

The CORE Token’s Role in Institutional DeFi

CORE powers:

- 🛠️ Smart contract execution

- 💸 Transaction fees

- 🗳️ Network governance

- 🔄 Staking and validator rewards

This makes CORE the engine behind Coreum’s institutional-grade DeFi ecosystem.

Institutional DeFi Use Cases

- 🏦 Tokenized Bond Marketplaces

- 💰 On-Chain Investment Funds

- 📈 Real-Time Settlement for Securities

- 🧑⚖️ Regulated DAO Governance Platforms

- 🏛️ Bank-Integrated DeFi Services

Why Coreum Stands Out

Unlike other DeFi platforms, Coreum:

- ✅ Builds for compliance-first adoption

- ✅ Offers real-world asset tokenization

- ✅ Provides high-speed, low-cost infrastructure

- ✅ Bridges institutional and retail markets

Final Thoughts

Coreum isn’t just another blockchain — it’s the future of regulated, institutional DeFi.

By combining compliance, speed, and real-world asset access, Coreum is opening the door for banks and financial institutions to fully embrace decentralized finance.

At Ripplexity, we’ll continue covering Coreum’s journey to power the next generation of institutional DeFi.