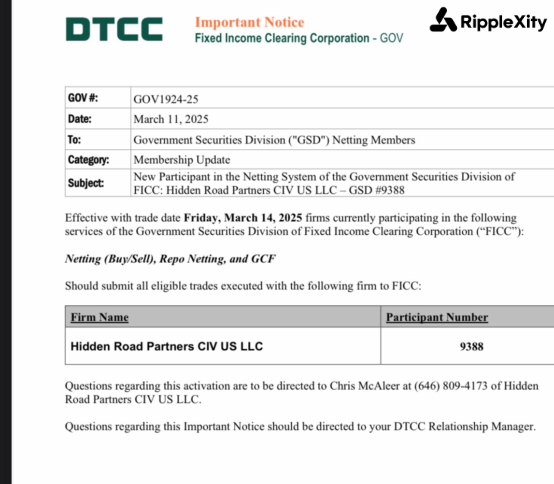

A recent discovery by the XRP community may signal one of Ripple’s most strategically significant moves to date. Hidden Road — a prime brokerage firm now registered with the Fixed Income Clearing Corporation (FICC) — has been quietly acquired by Ripple, according to social media findings first brought to light by community researcher Matthew.

The FICC, through its Government Securities Division (GSD), clears more than $11 trillion in daily trading volume. This registration opens a path for Ripple to access institutional markets at an unprecedented scale — with massive implications for the XRP Ledger (XRPL), XRP, and the company’s upcoming stablecoin, RLUSD.

Institutional-Grade Infrastructure Meets High-Volume Rails

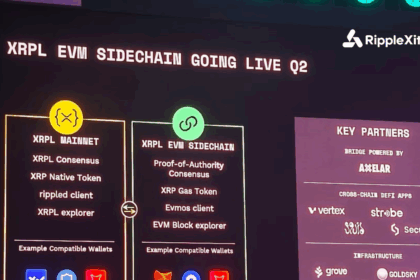

Ripple’s expanding suite of financial infrastructure — including XRPL, the XRP token, and the soon-to-launch RLUSD — now has potential exposure to one of the largest liquidity networks in global finance. Hidden Road’s membership in FICC allows it to clear U.S. government securities trades, a sector trusted and used by top-tier banks and hedge funds worldwide.

This infrastructure could enable Ripple to position XRP and RLUSD as part of institutional payment and settlement workflows. RLUSD is expected to handle most dollar-denominated on-chain transactions, while XRP will continue to serve as the network fee and collateral layer — with its supply reduced over time through burned transaction fees.

Why This Matters for XRP’s Price and Utility

While Ripple has not officially confirmed the acquisition, the implications are substantial. If even 1% of FICC’s daily trading volume (equivalent to $110 billion) begins to flow through Ripple’s rails, it would significantly increase demand for XRP’s core utility functions. That includes:

- Settlements on XRPL

- Transaction fees (burned in each use)

- Possible use as collateral in tokenized financial instruments

This could elevate XRP from a speculative asset to a core infrastructure token embedded within regulated, institutional capital markets.

A Strategic Step Toward Mainstream Integration

With RLUSD poised to facilitate stable, compliant dollar transactions, and XRP’s architecture designed for speed, scalability, and low cost, this move could represent Ripple’s next phase: bridging traditional financial infrastructure with blockchain-native rails — at global scale.

📌 Stay updated with RippleXity as we continue tracking this story and its long-term impact on the XRP ecosystem.