While most blockchains focus on DeFi or retail crypto applications, Coreum is taking a different path — building a high-performance, enterprise-grade Layer-1 blockchain designed to bring regulated financial assets on-chain.

With the backing of the Sologenic Development Foundation, Coreum is positioned as the next-generation infrastructure for banks, asset managers, and financial institutions looking to tokenize real-world value.

Let’s explore how Coreum, available at coreum.com, is becoming a powerhouse blockchain for regulated finance.

What Is Coreum?

Coreum is a Layer-1, Proof-of-Stake (PoS) blockchain purpose-built to:

- 🏛️ Tokenize traditional financial assets

- 🏦 Enable institutional-grade DeFi

- 🌐 Offer cross-chain interoperability

- ⚡ Provide high-speed smart contract execution

While XRPL powers tokenized trading through Sologenic, Coreum extends the ecosystem with enterprise features, compliance tools, and custom modules for regulated finance.

Key Features of Coreum

✅ Smart Tokenization Framework

Coreum allows regulated asset issuers to:

- Tokenize bonds, stocks, ETFs, and commodities

- Customize asset compliance rules on-chain

- Enable real-world asset liquidity 24/7

✅ Enterprise-Grade Smart Contracts

Unlike XRPL, Coreum supports advanced smart contract logic for:

- Asset management

- Governance

- Financial derivatives

- Structured products

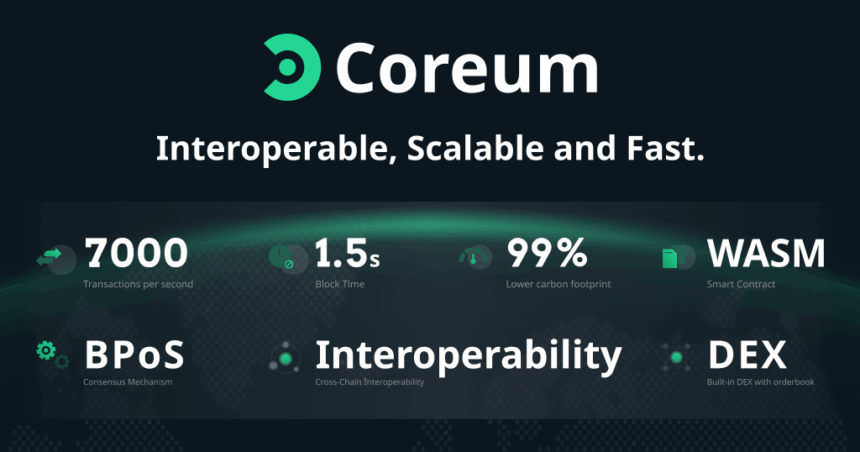

✅ High-Speed, Low-Cost Transactions

With sub-second finality and fractional-cent fees, Coreum is built for high-volume, institutional use.

✅ Interoperability

Coreum’s cross-chain bridges expand liquidity and connectivity to other major ecosystems like Ethereum and XRPL.

The Role of the CORE Token

The CORE Token powers the Coreum network by:

- 💸 Paying transaction fees

- 🔄 Enabling staking and network security

- 🗳️ Providing governance rights

- 🛠️ Fueling smart contract execution

CORE is the economic engine behind Coreum’s institutional-grade blockchain ecosystem.

Why Coreum Matters for Regulated Finance

Coreum’s infrastructure is tailored for:

- 🏛️ Banks tokenizing traditional financial instruments

- 🏦 Asset managers offering on-chain investment products

- 💼 Enterprises building blockchain-powered financial services

This positions Coreum as a trusted partner for the financial industry’s digital transformation.

Final Thoughts

While the crypto world chases the next meme token, Coreum is quietly building the rails for the future of regulated, institutional blockchain adoption.

With its smart tokenization tools, enterprise-ready smart contracts, and cross-chain capabilities, Coreum is shaping the future of real-world asset tokenization.

At Ripplexity, we’ll continue covering how Coreum powers the next generation of institutional blockchain applications.