Tokenization is more than minting digital assets — it’s about structuring them for utility, compliance, and scalability.

Most blockchains offer basic token standards like ERC-20 or XLS-20, but these lack the flexibility that enterprises and regulators demand.

Coreum changes the game with its Smart Tokenization Framework, designed for customizable, regulatory-friendly asset issuance.

This framework positions coreum.com as a next-gen tokenization engine for financial institutions, governments, and enterprise builders.

The Problem With Basic Token Standards

Traditional token standards:

- 🛑 Lack built-in compliance controls

- 🛑 Can’t define jurisdictional restrictions

- 🛑 Offer limited customization for real-world use cases

This makes them unsuitable for regulated assets like:

- Bonds

- Stocks

- Real estate

- Government-issued digital assets

What Makes Coreum’s Smart Tokenization Different?

Coreum’s framework allows issuers to define custom token parameters, including:

✅ Regulatory Compliance Controls

- KYC/AML enforcement

- Jurisdictional restrictions

- Transfer approval mechanisms

✅ Custom Utility Definitions

- Voting rights

- Dividend payouts

- Access permissions

✅ Lifecycle Management

- Scheduled burns or redemptions

- Supply adjustments

- Governance upgrades

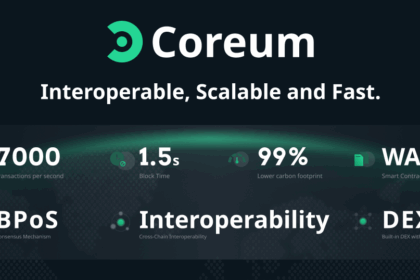

✅ Interoperability Standards

- Cross-chain compatibility via IBC

- Integration with XRPL and Ethereum ecosystems

Key Benefits for Issuers

- 🏦 Banks can tokenize bonds and structured products

- 🏛️ Governments can issue regulated stablecoins or CBDCs

- 🏢 Enterprises can tokenize equity or loyalty programs

- 🧑💻 Startups can launch fully customizable utility tokens

Why This Matters for Real-World Adoption

Institutions won’t adopt tokenization without:

- ✅ Control

- ✅ Compliance

- ✅ Custom utility

Coreum’s Smart Tokenization makes this possible at scale, bridging Web2 regulations with Web3 infrastructure.

Final Thoughts

Coreum isn’t just enabling tokenization — it’s making it enterprise-ready, compliance-friendly, and globally scalable.

At Ripplexity, we’ll continue covering how Coreum empowers regulated tokenization to bring real-world finance on-chain.