Asset tokenization is widely regarded as one of the most transformative applications of blockchain technology — with the potential to reshape capital markets, democratize access to investments, and enable near-instantaneous settlement of traditional assets. Among the emerging platforms aiming to lead this evolution, Coreum has positioned itself not just as a fast Layer-1 blockchain, but as a purpose-built infrastructure for real-world asset tokenization and enterprise-grade adoption.

This article explores Coreum’s unique approach to tokenization, its technical framework, and how it is architecting the future of programmable financial instruments — from tokenized stocks and bonds to real estate and commodities.

The Tokenization Thesis: A $16 Trillion Opportunity

Traditional finance (TradFi) faces longstanding inefficiencies: delays in clearing and settlement, high fees, and limited access to asset classes based on geography or accreditation status. Blockchain enables the digitization of real-world assets (RWAs), allowing them to be fractionalized, transferred, and settled in real-time on decentralized networks.

According to estimates by Boston Consulting Group, the tokenization of illiquid assets could reach $16 trillion by 2030. From private equity to real estate, the shift toward digital representation of value is underway — and Coreum is emerging as a key infrastructure enabler in this landscape.

Why Coreum for Tokenization?

Unlike general-purpose chains, Coreum is designed from the ground up to support high-throughput, regulatory-compliant, and customizable tokenization use cases. Key differentiators include:

🧱 Smart Token Infrastructure

Coreum introduces Smart Tokens — natively programmable assets that embed logic directly at the protocol level. Unlike ERC-20 tokens that rely on external smart contracts, Coreum’s Smart Tokens carry functionality such as:

- Auto-distribution of fees or yields

- Dynamic metadata updates

- Conditional asset locks

- Regulatory transfer restrictions

This approach offers greater efficiency, composability, and compliance potential for institutions looking to tokenize assets without introducing external security risks.

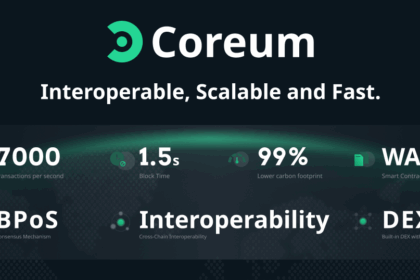

⚡ High-Performance Layer-1

With 7,000+ transactions per second (TPS), sub-second block finality, and deterministic performance, Coreum supports real-time token transfers and complex issuance flows without congestion or high fees — essential for enterprise token operations.

🔒 Built-in Compliance Modules

Token issuers on Coreum can implement KYC/AML policies, whitelists, blacklists, and jurisdictional constraints using core protocol features — not third-party plugins. This makes it easier to meet regulatory requirements for tokenized securities and stablecoins.

🌍 Interoperability and CosmWasm Smart Contracts

Coreum supports CosmWasm-based smart contracts, enabling integrations with the wider Cosmos and IBC ecosystem. Cross-chain tokenization (e.g., issuing tokens on Coreum but redeeming them on other chains) becomes seamless, opening up new DeFi and TradFi bridges.

Use Cases of Tokenization on Coreum

🏛️ Tokenized Equities & Bonds

Coreum provides a compliant and scalable platform to issue and manage digital versions of equities or fixed-income instruments. These could be offered through security token offerings (STOs), traded 24/7, and settled with stablecoins in seconds — without custodial intermediaries.

🏗️ Real Estate Tokenization

Using Coreum’s smart token logic, real estate projects can tokenize ownership or revenue-sharing rights. Compliance filters ensure only qualified investors can purchase tokens, while rental income could be auto-distributed via on-chain mechanisms.

💎 Commodities & Supply Chain Assets

Tokenizing assets like gold, oil, or even carbon credits becomes efficient with Coreum’s infrastructure. Real-world data or oracles can be integrated to represent asset state, allowing dynamic pricing and redemption logic.

🎓 Institutional Grade Stablecoins

Coreum supports the creation of CBDC-like stablecoins or private banking stablecoins. With built-in compliance modules and token controls, issuers can maintain full oversight while ensuring stable, frictionless transfers across borders.

Coreum’s Regulatory Alignment

Tokenization without regulation is a non-starter for institutional players. Coreum is proactively aligning its infrastructure with anticipated regulations like:

- MiCA (EU) — Markets in Crypto Assets regulation

- SEC/FINRA guidelines (US) for tokenized securities

- FATF travel rule and digital identity frameworks

By building compliance into the protocol, Coreum offers a future-proof foundation for legal token issuance, unlike chains where regulation must be retrofitted or externally enforced.

Developer and Enterprise Ecosystem

Coreum is expanding its ecosystem through:

- Hackathons focused on financial DApps

- Enterprise SDKs for tokenization workflows

- Partnerships with asset managers and fintech firms for pilot token launches

The platform has already seen the launch of several tokenized assets and DeFi integrations, and the roadmap includes native DEXs, liquidity protocols, and more cross-chain bridges.

Final Thoughts

While many blockchains discuss tokenization, Coreum is delivering it as infrastructure — combining speed, compliance, and advanced token programmability.

Its Smart Token model is not just a technological innovation, but a paradigm shift: allowing institutions to mint, manage, and distribute assets with embedded governance, rights, and automation — all directly at the protocol layer.

As global capital markets evolve into programmable, 24/7 ecosystems, Coreum is positioned to become one of the foundational chains bridging TradFi and DeFi through secure, efficient, and compliant asset tokenization.

Stay tuned with RippleXity for more on Coreum’s unfolding tokenization era.