For decades, SWIFT has been the backbone of international banking. Established in the 1970s, it enables banks around the world to communicate securely about financial transactions.

But in a digital age demanding speed, transparency, and cost-efficiency, SWIFT is increasingly showing its age.

Enter RippleNet — Ripple’s global payment network — offering a blockchain-based alternative that threatens to disrupt and redefine the global financial infrastructure.

The Legacy System: SWIFT’s Bottlenecks

While widely adopted, SWIFT is not a payment system itself, but a messaging protocol. Banks use it to send payment instructions — actual settlement can take 2 to 5 business days, especially for cross-border transactions. The system is also:

- Burdened by multiple intermediaries.

- Costly, with fees stacking up per transaction.

- Opaque — users often don’t know the real-time status of funds.

- Vulnerable to errors and compliance delays.

In short, SWIFT was not built for the on-demand, globalized economy we now live in.

RippleNet: A New Standard for Global Transactions

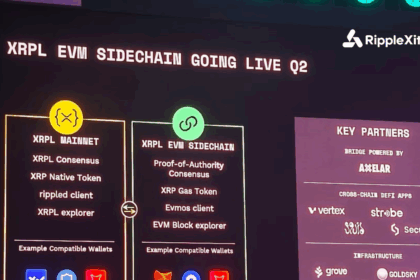

RippleNet leverages the XRP Ledger (XRPL) to provide real-time settlement, end-to-end transparency, and negligible fees. Unlike SWIFT, RippleNet offers both messaging and settlement, collapsing what SWIFT does in days into mere seconds.

Key Features of RippleNet:

- Speed: Transactions settle in 3–5 seconds.

- Cost-Efficiency: Cross-border fees are dramatically lower.

- Transparency: Real-time tracking and immutable records.

- Liquidity via XRP: With On-Demand Liquidity (ODL), XRP is used as a bridge currency — eliminating the need for pre-funded nostro accounts.

- Compliance-Ready: RippleNet integrates regulatory tools like KYC/AML natively.

Real-World Adoption

RippleNet isn’t theoretical — it’s already being used by over 100 financial institutions worldwide, including:

- Santander

- SBI Holdings

- Pyypl

- Tranglo

- Novatti

Countries like the UAE, Japan, and the Philippines are using Ripple-powered corridors to move billions — with instant finality and transparent audit trails.

Meanwhile, SWIFT is scrambling to modernize with its gpi (Global Payments Innovation) upgrade — but the progress is slow and still reliant on the traditional rails.

The Bigger Picture

RippleNet doesn’t just challenge SWIFT — it reimagines the entire payments landscape, making it more inclusive for:

- Emerging markets with limited banking infrastructure.

- Fintechs and remittance platforms looking for efficient liquidity.

- Retail users demanding cheaper global transactions.

As the world shifts toward CBDCs, tokenized assets, and 24/7 digital finance, RippleNet stands as a next-gen financial network — not just for banks, but for the Web3 economy.

Conclusion: A Shift in Financial Power

The race between RippleNet and SWIFT isn’t just about technology — it’s about who will control the future of money movement.

Ripple offers a decentralized, transparent, and efficient solution — aligned with the digital-first era.