The XRP ecosystem witnessed a notable spike in trading activity, with 24-hour volume reaching $4.64 billion, marking a 39.86% increase compared to the previous day. This uptick reflects renewed interest from traders and institutions amid ongoing developments surrounding Ripple and XRP adoption.

Market Response to Regulatory Developments

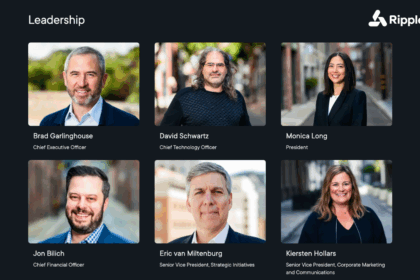

The surge in volume coincides with a series of critical regulatory and legal updates. Ripple’s ongoing settlement negotiations with the U.S. Securities and Exchange Commission (SEC), coupled with progress in resolving long-standing legal hurdles, may be fueling confidence in XRP’s near-term prospects.

Strengthening XRP’s Market Position

The volume growth positions XRP among the top actively traded digital assets, signaling heightened liquidity and trader engagement. It also reflects sustained interest in XRP’s role in cross-border payments, tokenized asset infrastructure, and institutional DeFi—especially as integrations like RLUSD, Circle USDC, and tokenized treasuries continue expanding on the XRP Ledger (XRPL).

Technical & Sentiment Indicators

High trading volume often indicates increasing volatility and price movement potential. While XRP remains relatively stable around $2.16, the volume increase could foreshadow an upcoming breakout, especially as macro events and market sentiment evolve in favor of digital assets.

What’s Next?

With institutional adoption rising and legal clarity approaching, XRP is gaining traction not only as a speculative asset but also as a foundational utility token in the evolving digital financial ecosystem.